Payments & Transfer Review

The ACH User Interface Program extends the ability to review and approve ACH transfers that you generate or import.

The following sections display on this page:

Payments & Transfer Review Widget

Overview

Review ACH Transfers ensures that individual ACH users or financial institutions that are using the ACH User Interface can review and approve ACH transfers that exceed an established review thresholds.

Review ![]() threshold are established by an ACH administrative user and involve the following options.

threshold are established by an ACH administrative user and involve the following options.

Review Type

Review Thresholds

Financial Institution

Review All – indicates that any transfer submitted by a given ACH user or on behalf of a given ACH user that is tied to the limit group requires review and approval by the financial institution.

Financial Institution

The system requires financial institution review for a given ACH transfer when an established debit dollar value or credit dollar value threshold is exceeded for one or more of the following threshold types:

Daily Review Threshold

Settlement Date Review Threshold

Weekly Review Threshold

Monthly Review Threshold

Per Transfer Review Threshold

Per Batch Review Threshold

Client

Review All – indicates that any transfer submitted by a given ACH user or on behalf of a given ACH user that is tied to the limit group requires review and approval by a one or more clients associated with the transfer.

Client

The system requires review by one or more clients associated with the transfer for a given ACH transfer when an established debit dollar value or credit dollar value threshold is exceeded for one or more of the following threshold types:

Daily Review Threshold

Settlement Date Review Threshold

Weekly Review Threshold

Monthly Review Threshold

Per Transfer Review Threshold

Per Batch Review Threshold

Number of Client Approvals

Client review of ACH transfers includes the ability to establish how many clients are required to review and approve a given ACH transfer. The number of client approvals required for a given ACH transfer to continue processing is established by your financial institution’s administrative users.

The individual that submits a transfer cannot approve their own transfer.

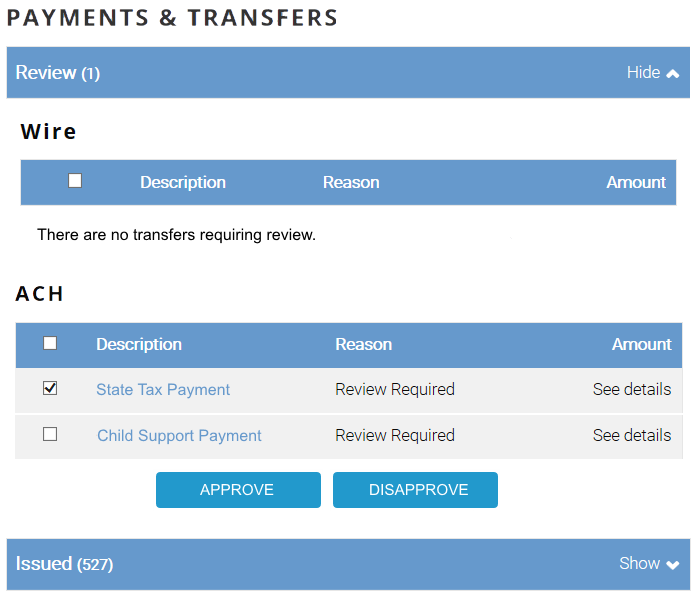

Payments & Transfer Review Widget

The Payments & Transfers review section is a widget that populates the Home page. This widget enables users with sufficient permissions to review ACH transfers and wire transfers. The ACH Transfers portion of this widget populates with the ACH transfers that meet the following criteria:

-

Exceed an established review threshold

-

Require one or more clients to review the transfers

ACH transfers that are submitted by one particular ACH user (for example, John Adams) and require client review are not visible to John Adams when he logs into Business Online and reviews the transfers present in the Review Transfers widget. They would be visible to another user that is associated with Mr. Adams' employer and possesses the requisite permissions to review and approve ACH transfers. Refer to the Review ACH Transfers procedures for guidance in the execution of ACH transfer review using the Business Online Review Transfers widget.

The ![]() permissions that you establish for that particular ACH User governs what an ACH user can see and interact with once they log into Business Online.

permissions that you establish for that particular ACH User governs what an ACH user can see and interact with once they log into Business Online.

For example, John Adams is an employee of Washington Orchards and is setup with permissions that include the review of ACH transfers. Subsequently, when John Adams logs into Business Online he sees the Review Transfers widget and he is able to engage the Review ACH Transfer functionality within the ACH User Interface.

Thomas Jefferson, another employee of Washington Orchards is setup with permissions that do not include the review of ACH transfers. Subsequently, when Thomas Jefferson logs into Business Online he does not see the Review Transfers widget nor is he able to engage the Review ACH Transfer functionality.

Review ACH Transfer Functionality

Once the system displays the Payments & Transfers list, you can approve or disapprove individual ACH transfers by selecting the appropriate check box. You can select individual items for review or select all by selecting the check box next to Description. You can click Approve to approve all transfers that you have selected, or you can click Disapprove to reject all the transfers that you have selected.

Payments & Transfer Review

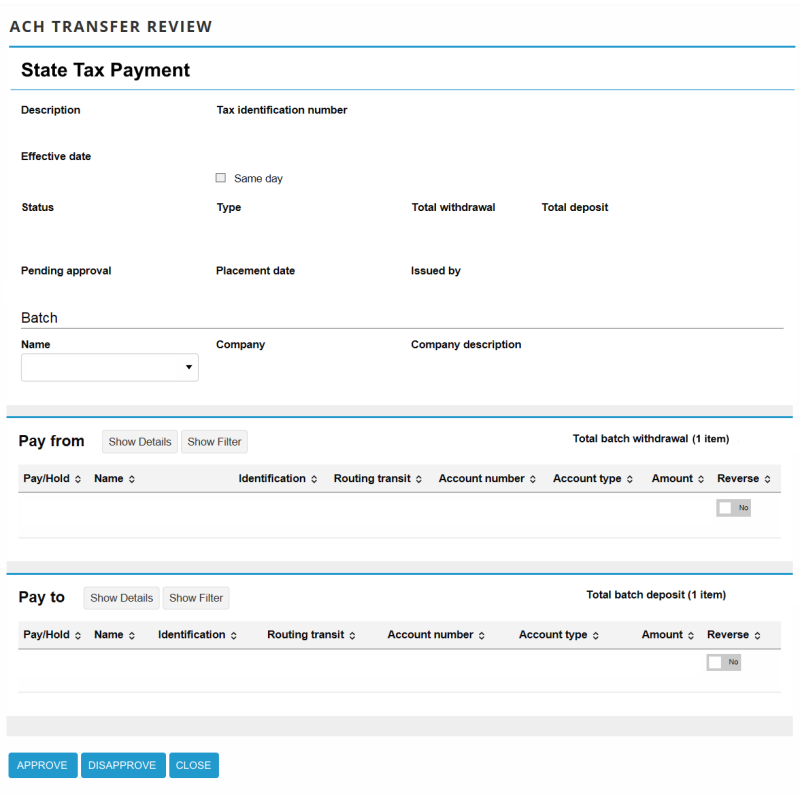

The Review ACH Transfers list populates with a number of fields that communicate information about the ACH transfers that require review or offers an action that can be executed in order to approve or disapprove ACH transfers.

Description

The name of the ACH transfer that was submitted for processing. For example, Wash Orch Payroll might be used to describe a payroll transfer submitted by the client Washington Orchards.

Tax identification number

The tax identification number of the account owner at the Originating Depository Financial Institution (ODFI).

Effective date

The date placed on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

Status

The Status drop-down list defaults to a value of Outstanding which indicates that the ACH transfer has not been reviewed and approved or reviewed and disapproved. Selecting Approved from the Status drop-down list approves the associated ACH transfer for further processing. Selecting Disapproved from the Status drop-down list stops the associated ACH transfer from further processing.

Type

The type of transfer that the user selected.

Total withdrawal

The total amount that the system debits from the account at the Originating Depository Financial Institution (ODFI).

Total deposits

The total amount that the system credits to the account at the Receiving Depository Financial Institution (RDFI). For ACH Incoming transfers, payments are made to the on-us account and withdrawals are made against the account at the Receiving Depository Financial Institution (RDFI).

Pending approval

The number of remaining approvals that the system requires for the transfer.

The date the ACH transfer was marked for additional client or financial institution review.

Issued by

Identifies the individual that issued the transaction.

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

See Also:

Establish a New ACH Collection

Back to Top