ACH Transfers – Unique Fields

The ACH User Interface Program extends the ability to generate, import, edit, review, approve, and delete NACHA and Non-NACHA formatted ACH transfers. When you are working with ACH transfers there are certain fields that apply across most of the ACH transfer types. Subsequently, the majority of the ACH transfer types that you generate or import populate the user interface in the same fashion regardless of activity you are undertaking. However, the ACH User Interface also includes a number of transfer types that make use of fields that are unique to that particular transfer type.

The following sections display on this page:

Fields Specific to Child Support Payments

Correspondent Bank Information

Child Support Agencies

Child support agencies are one of the ACH transfer types that are available for use by financial institution users and their clients. Financial institution users and their clients can generate and manage child support payment ACH transfer types using the standard ACH User Interface functions. Child support agencies transfers include three main sections: Transfer overview, Pay from, and Pay to.

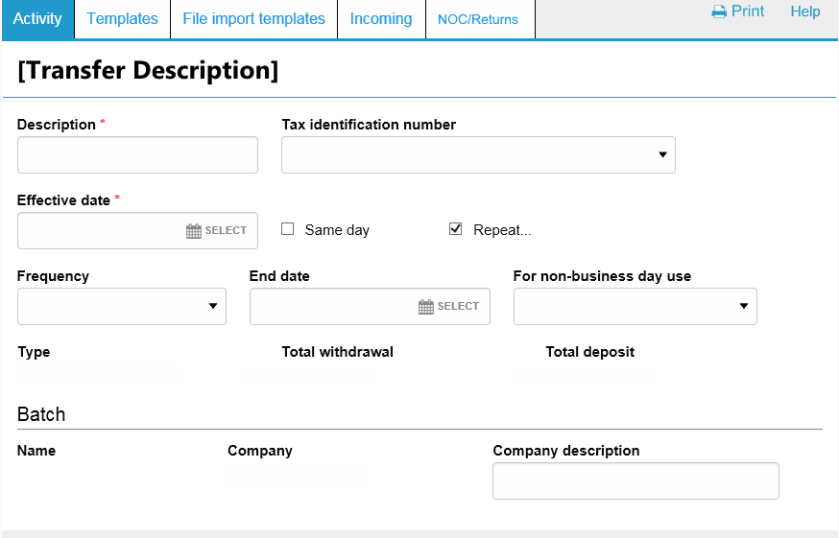

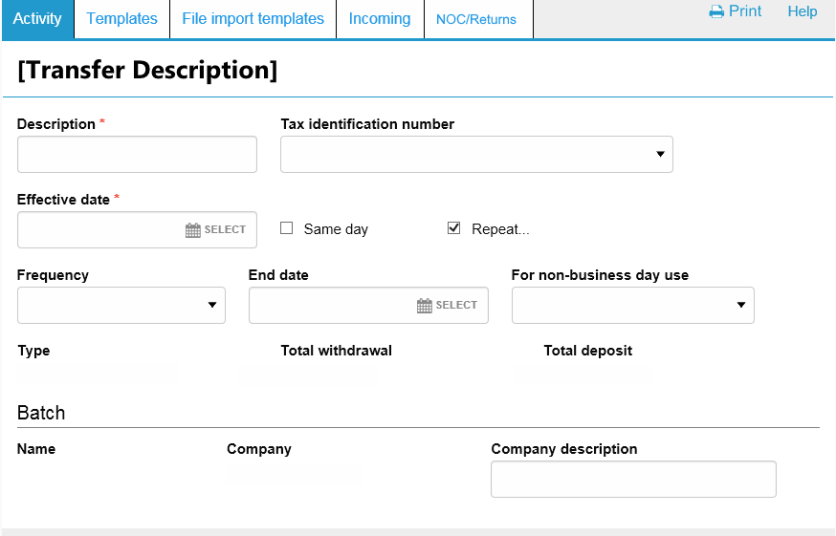

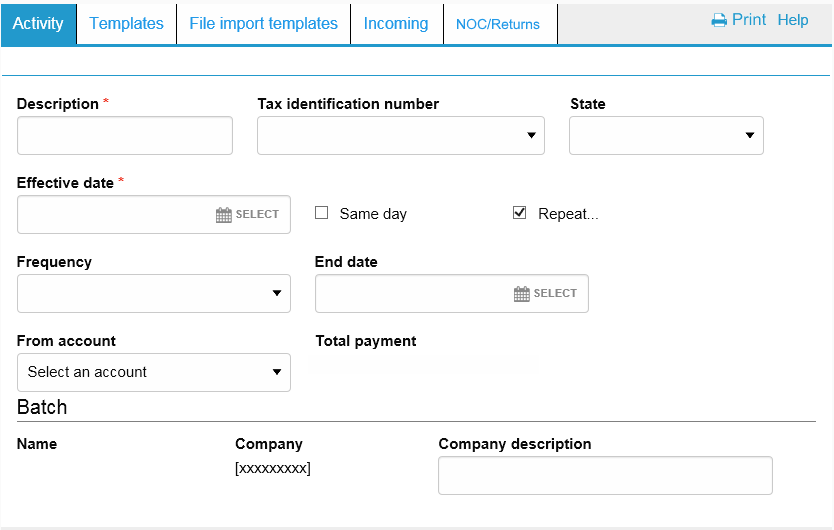

Transfer Overview

The transfer overview section is always the first block of information that the system presents when you view an ACH transfer. It contains some header information that provides a description of the transfer name (for example, New ACH - Child support agencies- PPD) and a number of fields that communicate basic information about the transfer such as the name, the effective date, and the total debit amount.

Description

The Description ![]() field appears on every ACH transfer that you generate or import into ACH.

field appears on every ACH transfer that you generate or import into ACH.

The system uses it to attach a name or description to the transfer that is recognizable to the submitter. For example, a child support transfer submitted by John Adams or on behalf of John Adams might utilize the verbiage "JAdams Child Support".

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

Effective date

The Effective date ![]() field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

You can enter the effective date in a number of ways:

-

Type the date with forward slashes to differentiate between day, month, and year. For example, type May 5, 2015 as 05/15/2015.

-

Click

and then selecting the date you want to serve as the effective date for the transfer.

and then selecting the date you want to serve as the effective date for the transfer.

-

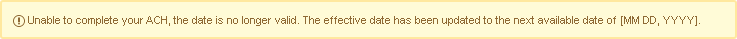

In the event that you enter a date that is not a valid processing day, the user interface displays a warning message indicating that the date you selected is not a valid processing day and the system automatically selects the next available processing date. If this warning message appears, click Process ACH or Save for later or enter a new Effective date.

Same day

Select the Same day check box to assign the specified transfer as same day transfer. When you select the Same day check box, the system enters today's date as the Effective date and you cannot modify the Effective date.

Repeat

Select the Repeat check box to establish the frequency, the date that the recurring transfer ends, and which processing day the system uses when the date falls on a nonprocessing date.

Frequency

Indicates the ![]() frequency that the recurring transfer occurs.

frequency that the recurring transfer occurs.

|

Daily |

indicates the recurring transfer occurs daily |

|

Weekly |

indicates the recurring transfer occurs weekly |

|

Every two weeks |

indicates that the recurring transfer occurs every two weeks |

|

Monthly |

indicates the recurring transfer occurs monthly |

|

End of month |

indicates the recurring transfer occurs at the end of the month |

|

Every two months |

indicates the recurring transfer occurs every two months |

|

Quarterly |

indicates the recurring transfer occurs quarterly |

|

Every six months |

indicates the recurring transfer occurs every six months |

|

Annually |

indicates the recurring transfer occurs annually |

End date

The date the originator intends the recurring transfer cycle to end. Type the date (mm/dd/yyyy) that you want the recurring transfer cycle to end or click ![]() to select the date you want the recurring transaction cycle to end.

to select the date you want the recurring transaction cycle to end.

For non-business day use

Indicates whether the system ![]() uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

|

Next business day |

indicates that the system uses the next business day to process transactions that are scheduled on a non-business day. |

|

Previous business day |

indicates the system uses the previous business day to process transactions that are scheduled on a non-business day. |

Type

Payment (Child support agencies - CCD)

Total withdrawal

The total amount that the system debits from the account at the Originating Depository Financial Institution (ODFI).

Total deposits

The total amount that the system credits to the account at the Receiving Depository Financial Institution (RDFI). For ACH Incoming transfers, payments are made to the on-us account and withdrawals are made against the account at the Receiving Depository Financial Institution (RDFI).

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

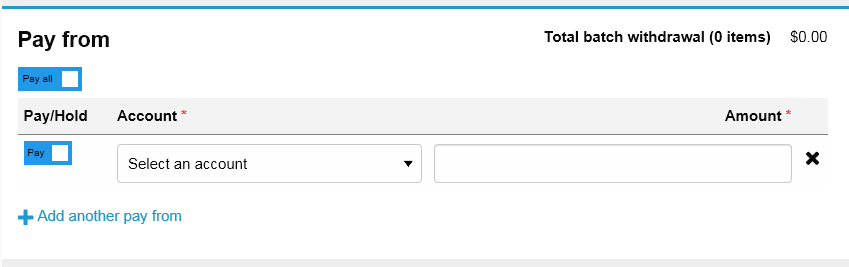

Pay From

The following fields populate the Pay From section of a child support payment.

Pay all

Click the Pay all switch to turn on the Hold option for all transfers in the batch. A hold stops the system from submitting the indicated transfers to the financial institution during processing and saves the transfer for future use. To remove the hold for all the specified transfers in the batch, click the Hold all switch to turn on the Pay option and proceed with processing all transfers in the batch.

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Account

The account at the Originating Depository Financial Institution (ODFI).

Amount

The amount to be withdrawn from the account that you specify.

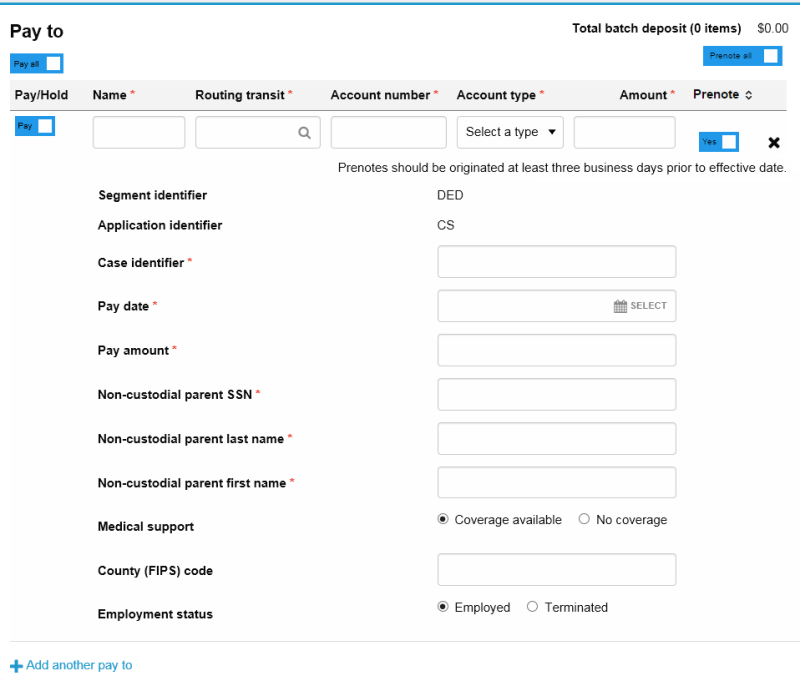

Pay To

When you generate a child support payment and the system establishes the DED Segment Addendum Record is, it would look like the following example.

Pay all

Click the Pay all switch to turn on the Hold option for all transfers in the batch. A hold stops the system from submitting the indicated transfers to the financial institution during processing and saves the transfer for future use. To remove the hold for all the specified transfers in the batch, click the Hold all switch to turn on the Pay option and proceed with processing all transfers in the batch.

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Segment identifier

The DED (Data Segment Identifier for Deductions).

Application identifier

The supporting identifier for the DED segment. The system automatically populates this field as CS.

Case identifier

The alpha numeric value that represents the child support case that the system associates with the child support payment.

Pay date

The date of the child support payment.

Pay amount

The dollar amount of the child support payment to be debited from the user's account.

Non-custodial parent SSN

The Social Security Number of the noncustodial parent

Non-custodial parent last name

The last name of the noncustodial parent

Non-custodial parent first name

The first name of the noncustodial parent

Medical support

Select whether or not the individual submitting the child support payment has Coverage available or No coverage for health insurance at their place of employment.

County (FIPS) code

The Federal Information Processing Standards (FIPS) code of the child support enforcement entity receiving the child support payment.

Employment status

Select whether or not the individual submitting the child support payment is Employed or Terminated.

Prenote

Select the "Prenote" check box to add a zero dollar prenote transfer for the current business day. Click the "Select All" hyperlink to place a check mark in all of the check boxes. Click the "Select None" hyperlink to clear all of the check boxes.

Fields Specific to Child Support Payments

When you generate a child support payment, the system includes the DED (Data Segment Identifier for Deductions) Segment Addendum Record. The system builds the addendum record in accordance with the DED Child Support Segment Structure. The DED Child Support Segment Structure enables the originator of the transaction to provide specific Electronic Data Interchange (EDI) structured data about the child support payment and the payer. This structure is comprised of a number of elements that communicate information about the child support payment and the payer. The following ![]() table illustrates the breakdown of the structure as well as bulleted notes for each structure element that communicate how the ACH User Interface implements that element during the generation of child support payments.

table illustrates the breakdown of the structure as well as bulleted notes for each structure element that communicate how the ACH User Interface implements that element during the generation of child support payments.

|

Element |

Comments |

Contents |

Attributes |

|---|---|---|---|

|

|

Segment identifier |

DED |

Mandatory identification field that contains three characters.

|

|

DED 01 |

Application identifier |

CS |

Mandatory identification field that contains two characters.

|

|

DED 02 |

Case identifier |

XXXXXXXXX |

Mandatory data field that can contain between one and twenty alpha numeric characters.

|

|

DED 03 |

Pay date |

YYMMDD |

Mandatory data field that defines the EDI standard format for the Date, the last two digits of the numeric year (YY), followed by the two digit numbers for the month (MM), and day (DD) of the date.

|

|

DED 04 |

Payment amount |

$$$$$$$$CC |

Mandatory data field that defines the amount of the child support payment. This numeric field can contain a minimum of one digit, and a maximum of ten digits.

|

|

DED 05 |

Non-custodial parent SSN |

XXXXXXXXX |

Mandatory data field that represents the social security number of the individual making the child support payment. It is the individual's unique identifier.

|

|

DED 06 |

Medical support |

Y = Yes N = No |

Mandatory data field used to indicate whether or not the individual submitting the child support payment has health insurance available at their place of employment.

|

|

DED 07 |

Non-custodial parent name |

XXXXXXXXXX |

Optional data field that contains the name of the individual making the child support payment. This should include the first seven characters of the individual's last name, followed by the first three characters of the first name. If the last name is less than seven characters, the system uses a comma to separate the last character of the last name from the first character of the first name, with no spaces between.

|

|

DED 08 |

County (FIPS) code |

XXXXXXX |

Optional data field that contains the assigned Federal Information Process Standard (FIPS) code of the child support enforcement entity receiving the child support payments. The field requires a minimum of five alpha numeric characters and can contains a maximum of seven alpha numeric characters. The State Child Support Enforcement (CSE) entity can provide the appropriate FIPS code for this data element field.

|

|

DED 09 |

Employment status |

Y = Yes |

Optional data field that the system uses to notify the CSE agency that the individual submitting the child support payment has been terminated by their employer. The system places a Y in this field to indicate the individual submitting the child support payment has been terminated by their employer.

|

|

Asterisks (*): the system uses asterisks as separators, and fillers. An asterisk should appear between each data element field, and in each optional data element field for which there is no data to indicate that the defined data element field is blank. Backward Slash ( \ ): is used by the system to denote the end of a Segment. |

|||

Example: DED*CS*12345678*151203*20000*000010123*Y*ADAMS,JOH*MD001*Y\

DED = Segment Identifier

CS = DED 01 (Application Identifier)

12345678 = DED 02 (Case Identifier)

151203 = DED 03 (Pay Date)

20000 = DED 04 (Pay Amount)

000010123 = DED 05 (Non-Custodial Parent SSN)

Y = DED 06 (Medical Support Indicator)

ADAMS = DED 07 (Non-Custodial Parent Last Name)

JOH = DED 07 (Non-Custodial Parent First Name)

MD001 = DED 08 (FIPS Code)

Y = DED 09 (Employment Termination Identifier)

Federal Tax Payment

Federal tax payments are one of the ACH transfer types that are available for use by financial institution users and their clients. Financial institution users and their clients can generate and manage federal tax payment ACH transfer types using the standard ACH User Interface functions. Federal tax payments include two sections: Transfer Overview, and Payments.

Transfer Overview

The transfer overview section is always the first block of information the system presents you when you view an ACH transfer. It contains some header information that provides a description of the transfer name (for example, New ACH - Federal taxes - CCD) and a number of fields that communicate basic information about the transfer such as the name, the effective date and the total debit amount.

The Description field appears on every ACH transfer that you generate or import.

Description

The Description ![]() field appears on every ACH transfer that you generate or import.

field appears on every ACH transfer that you generate or import.

It is utilized to attach a name or description to the transfer that is recognizable to the submitter. For example, a child support transfer submitted by John Adams or on behalf of John Adams might utilize the verbiage "JAdams Child Support".

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

Effective date

The Effective date ![]() field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

You can enter the effective date in a number of ways:

-

Type the date with forward slashes to differentiate between day, month, and year. For example, type May 5, 2015 as 05/15/2015.

-

Click

and then selecting the date you want to serve as the effective date for the transfer.

and then selecting the date you want to serve as the effective date for the transfer.

-

In the event that you enter a date that is not a valid processing day, the user interface displays a warning message indicating that the date you selected is not a valid processing day and the system automatically selects the next available processing date. If this warning message appears, click Process ACH or Save for later or enter a new Effective date.

Same day

Select the Same day check box to assign the specified transfer as same day transfer. When you select the Same day check box, the system enters today's date as the Effective date and you cannot modify the Effective date.

Repeat

Select the Repeat check box to establish the frequency, the date that the recurring transfer ends, and which processing day the system uses when the date falls on a nonprocessing date.

Frequency

Indicates the ![]() frequency that the recurring transfer occurs.

frequency that the recurring transfer occurs.

|

Daily |

indicates the recurring transfer occurs daily |

|

Weekly |

indicates the recurring transfer occurs weekly |

|

Every two weeks |

indicates that the recurring transfer occurs every two weeks |

|

Monthly |

indicates the recurring transfer occurs monthly |

|

End of month |

indicates the recurring transfer occurs at the end of the month |

|

Every two months |

indicates the recurring transfer occurs every two months |

|

Quarterly |

indicates the recurring transfer occurs quarterly |

|

Every six months |

indicates the recurring transfer occurs every six months |

|

Annually |

indicates the recurring transfer occurs annually |

End date

The date the originator intends the recurring transfer cycle to end. Type the date (mm/dd/yyyy) that you want the recurring transfer cycle to end or click ![]() to select the date you want the recurring transaction cycle to end.

to select the date you want the recurring transaction cycle to end.

For non-business day use

Indicates whether the system ![]() uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

|

Next business day |

indicates that the system uses the next business day to process transactions that are scheduled on a non-business day. |

|

Previous business day |

indicates the system uses the previous business day to process transactions that are scheduled on a non-business day. |

Type

Payment (Federal taxes - CCD)

Total withdrawal

The total amount that the system debits from the account at the Originating Depository Financial Institution (ODFI).

Total deposits

The total amount that the system credits to the account at the Receiving Depository Financial Institution (RDFI). For ACH Incoming transfers, payments are made to the on-us account and withdrawals are made against the account at the Receiving Depository Financial Institution (RDFI).

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

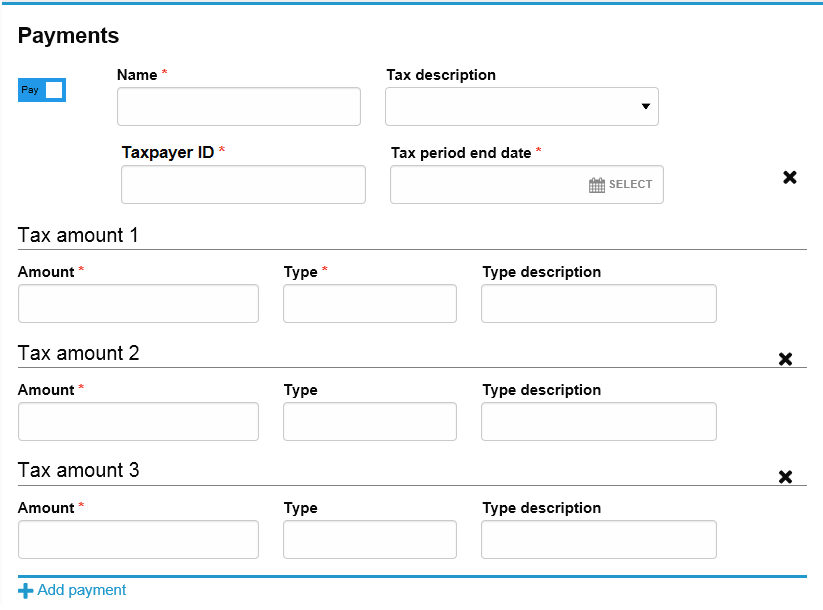

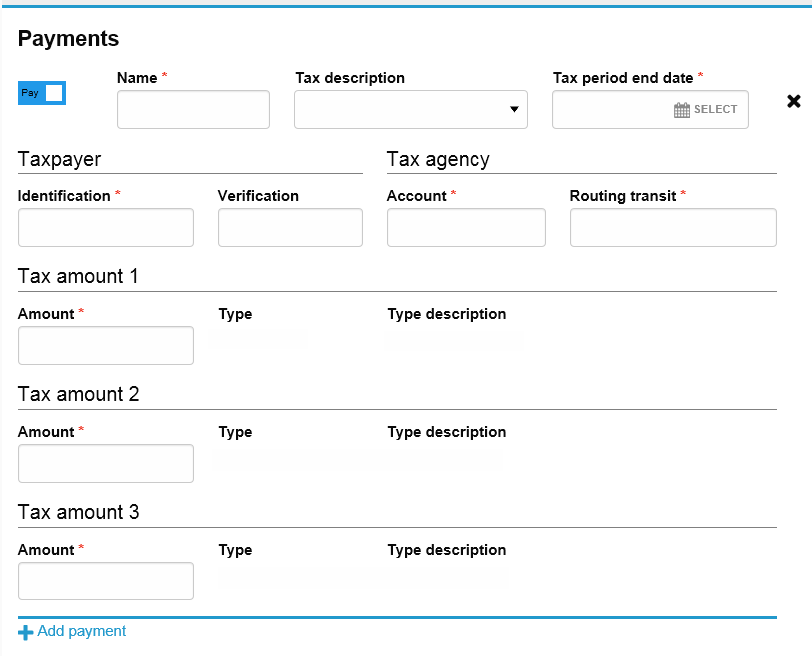

Payments

What makes the Federal tax payment ACH transfer type unique, is the federal tax payment information that populates the Payments section. This section includes fields that are unique to Federal tax payments and are not found in any other ACH transfer type. The following fields populate the Payments section.

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Name

The name of the recipient of the federal tax payment at the Receiving Depository Financial Institution (RDFI). By default, the ACH User Interface populates this field with the value IRS.

Tax description

The tax agency receiving the transfer. Entire states or individual state tax agencies that have been suppressed do not display in the Tax Description drop-down list.

Taxpayer ID

The tax identification number of the account owner at the Originating Depository Financial Institution (ODFI) that is submitting the federal tax payment.

Tax period end date

Indicates the last ![]() day of the tax period.

day of the tax period.

You can type a transfer's tax period end date in a number of ways:

-

Typing the date without any forward slashes to differentiate between day, month, and year. For example, 05052015 to represent May 5, 2015. When you type an effective date in this manner, the ACH User Interface updates the field to display the date with forward slashes (for example, 05052015 becomes 05/15/2015).

Typing the date with forward slashes to differentiate between day, month, and year. For example, you would enter May 5, 2018 as 05/15/2018.

Selecting the

icon and then selecting the date you want to serve as the effective date for the transfer.

icon and then selecting the date you want to serve as the effective date for the transfer.

Amount

The amount of the tax payment that is submitted. You can remove the tax amounts and the associated Amount, Type, and Type description fields from a federal tax payment by clicking ![]() for the tax amount row you want to delete.

for the tax amount row you want to delete.

Type

The tax type code the tax payment is associated with. The Amount fields automatically populate with numeric values that represent the tax type code selection made in the Tax description drop-down list. For example, if a user selected Heavy Vehicle Tax/22097 from the Tax Description/Tax Code drop-down list, the Type field populates with the value 22097.

Type description

The description of the associated Amount Type. By default, this field is blank when a selection is made from the Tax Description/Tax Code drop-down list. For example, you can type "Annual WH of Foreign" to represent a federal tax payment made for the Annual WH of Foreign Persons / 10427 tax type.

Add payment

You can add additional tax payments to a federal tax payment transfer by selecting the Add payment hyperlink. You can click the ![]() on the Payment Details caption bar to remove a federal tax payments.

on the Payment Details caption bar to remove a federal tax payments.

International

International (IAT) transfers are one of the ACH transfer types that are available for use by financial institution users and their clients. Financial institution users and their clients can generate and manage international ACH transfer types using the standard ACH functions.

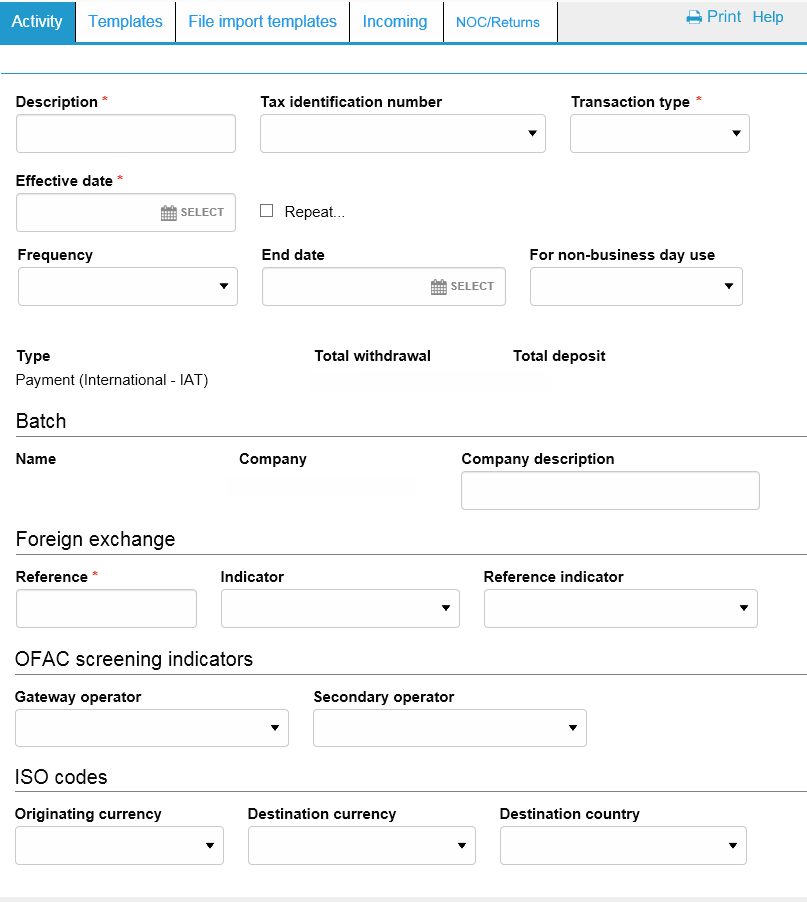

Transfer Overview

The transfer overview section is always the first block of information that the system presents when you view an ACH transfer. It contains some header information that provides a description of the transfer name (for example, New ACH International - IAT) and a number of fields that communicate basic information about the transfer such as the name, the effective date, and the total debit amount.

Description

The Description ![]() field appears on every ACH transfer that you generate or import.

field appears on every ACH transfer that you generate or import.

You can type up to 30 alpha, numeric or special characters. You can use this field to attach a name or description to the transfer that is recognizable to the submitter. For example, Washington Orchards submits a payroll transfer and uses the description "Wash Orch SEP Payroll."

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

Transaction type

The Transfer type field displays the ACH transfer ![]() type that is generated.

type that is generated.

|

None |

indicates a standard entry code is not associated with the transaction |

|

Accounts Receivable Entry |

indicates a consumer check converted to a one-time ACH debit |

|

Annuity |

indicates the transaction is associated with an annuity |

|

Back Office Conversion Entry |

indicates a single entry debit initiated at the point of purchase or at a manned bill payment location to transfer funds through conversion to an ACH debit entry during back office processing |

|

Business/Commercial |

indicates a debit or credit entry initiated by an originator to effect a transfer of funds to or from the account of that organization or another organization |

|

Deposit |

indicates a direct deposit that transfers funds into a consumer’s account at the Receiving Depository Financial Institution |

|

Internet-Initiated Entry |

indicates an electronic authorization through the Internet to create an ACH entry |

|

Loan |

indicates a loan (for example, revolving line of credit) is used as the ACH entry |

|

Miscellaneous |

indicates an unknown form of payment is made |

|

Mortgage |

indicates a mortgage (for example, home equity line of credit) is used as the ACH entry |

|

Pension |

indicates a pension is used as the ACH entry |

|

Point of Purchase Entry |

indicates a check presented in-person to a merchant for purchase is presented as an ACH entry instead of a physical check |

|

Point of Sale Entry |

indicates a debit at an electronic terminal initiated by a card (for example, ATM, Debit or Credit) |

|

Re-presented Check Entry |

indicates a physical check that was presented but returned because of insufficient funds may be represented as an ACH entry |

|

Remittance |

indicates a billing system is used (for example, utility provider) to transfer funds from a consumer account to a provider account |

|

Rent/Lease |

indicates a billing system is used by a landlord entity or owner to receive electronic payments for a rented or leased property |

|

Salary/Payroll |

indicates a payroll (for example, direct deposit) is used as the ACH entry |

|

Shared Network Transactions |

indicates a debit entry initiated at an electronic terminal as defined in Regulation E of The Board of Governors of the Federal Reserve System to pay an obligation incurred in a point-of-sale transaction, or to effect a transfer of funds from a deposit account (for example, a point-of-sale terminal cash withdrawal), and reversing, adjusting, and other credit entries relating to such debit entries, transfer of funds or obligations |

|

Tax |

indicates a tax payment is used as the ACH entry |

|

Telephone Initiated Entry |

indicates an oral authorization by telephone to issue an ACH entry such as checks by phone |

Effective date

The Effective date ![]() field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

You can enter the effective date in a number of ways:

-

Type the date with forward slashes to differentiate between day, month, and year. For example, type May 5, 2015 as 05/15/2015.

-

Click

and then selecting the date you want to serve as the effective date for the transfer.

and then selecting the date you want to serve as the effective date for the transfer.

-

In the event that you enter a date that is not a valid processing day, the user interface displays a warning message indicating that the date you selected is not a valid processing day and the system automatically selects the next available processing date. If this warning message appears, click Process ACH or Save for later or enter a new Effective date.

Repeat

Select the Repeat check box to establish the frequency, the date that the recurring transfer ends, and which processing day the system uses when the date falls on a nonprocessing date.

Frequency

Indicates the ![]() frequency that the recurring transfer occurs.

frequency that the recurring transfer occurs.

|

Daily |

indicates the recurring transfer occurs daily |

|

Weekly |

indicates the recurring transfer occurs weekly |

|

Every two weeks |

indicates that the recurring transfer occurs every two weeks |

|

Monthly |

indicates the recurring transfer occurs monthly |

|

End of month |

indicates the recurring transfer occurs at the end of the month |

|

Every two months |

indicates the recurring transfer occurs every two months |

|

Quarterly |

indicates the recurring transfer occurs quarterly |

|

Every six months |

indicates the recurring transfer occurs every six months |

|

Annually |

indicates the recurring transfer occurs annually |

Type

Payment (International - IAT)

Total withdrawal

The total amount that the system debits from the account at the Originating Depository Financial Institution (ODFI).

Total deposits

The total amount that the system credits to the account at the Receiving Depository Financial Institution (RDFI). For ACH Incoming transfers, payments are made to the on-us account and withdrawals are made against the account at the Receiving Depository Financial Institution (RDFI).

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

Foreign Exchange

Reference

The foreign exchange rate that the system uses to execute the foreign exchange conversion of a cross-border entry or another reference to the foreign exchange transaction. The Foreign exchange reference indicator defines the content in the International ACH (IAT) specifications. If you set the Foreign exchange indicator in the International ACH (IAT) specifications to a value of Fixed to Fixed Conversion, the Reference is space filled.

Indicator

The foreign exchange ![]() conversion methodology that the system applies to the transfer.

conversion methodology that the system applies to the transfer.

|

Fixed to Variable Conversion |

indicates the transfer is originated in a fixed-value amount and is received in a variable amount resulting from the execution of the foreign exchange conversion |

|

Variable to Fixed Conversion |

indicates the transfer is originated in a variable-value amount based upon a specific foreign exchange rate for conversion to a fixed-value amount in which the entry is received |

|

Fixed to Fixed Conversion |

indicates the transfer is originated in a fixed-value amount and is received in the same fixed-value amount in the same currency denomination. There is no foreign exchange conversion for entries transmitted using this code. |

Reference indicator

The ![]() type of information included in the Foreign Exchange Reference field located in New ACH - International ACH Transfer (IAT) template specification page.

type of information included in the Foreign Exchange Reference field located in New ACH - International ACH Transfer (IAT) template specification page.

|

Foreign Exchange Rate |

indicates a foreign exchange rate |

|

Foreign Exchange Reference Number |

indicates a foreign exchange reference number |

|

Space Filled |

indicates the foreign exchange reference number is space filled |

OFAC Screening Indicators

Gateway operator

The gateway operator OFAC ![]() screening indicator for OFAC compliance.

screening indicator for OFAC compliance.

|

None |

indicates that a screening has not been conducted |

|

0 |

indicates that the gateway operator did not find the blocked party |

Secondary operator

The ![]() results of a correspondent bank or other third-party screen for OFAC compliance.

results of a correspondent bank or other third-party screen for OFAC compliance.

|

None |

indicates a screening has not been conducted |

|

0 |

indicates the correspondent bank or other third-party did not find the blocked party |

ISO Codes

Originating currency

The currency code approved by the International Organization for Standardization (ISO) used to identify the currency denomination in which the transfer is originated.

Destination currency

The currency code approved by the International Organization for Standardization (ISO) used to identify the currency denomination in which the transfer is received.

Destination country

The currency code approved by the International Organization for Standardization (ISO) used to identify the country in which the transfer is received.

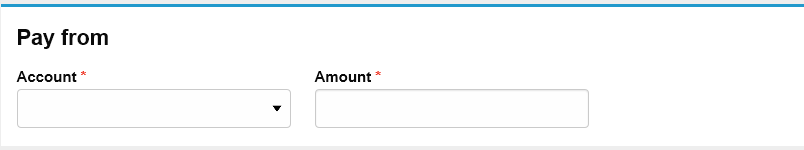

Pay From

The following fields populate the Pay from section of international ACH payment.

Account

The account at the Originating Depository Financial Institution (ODFI).

Amount

The amount to be withdrawn from the account that you specify.

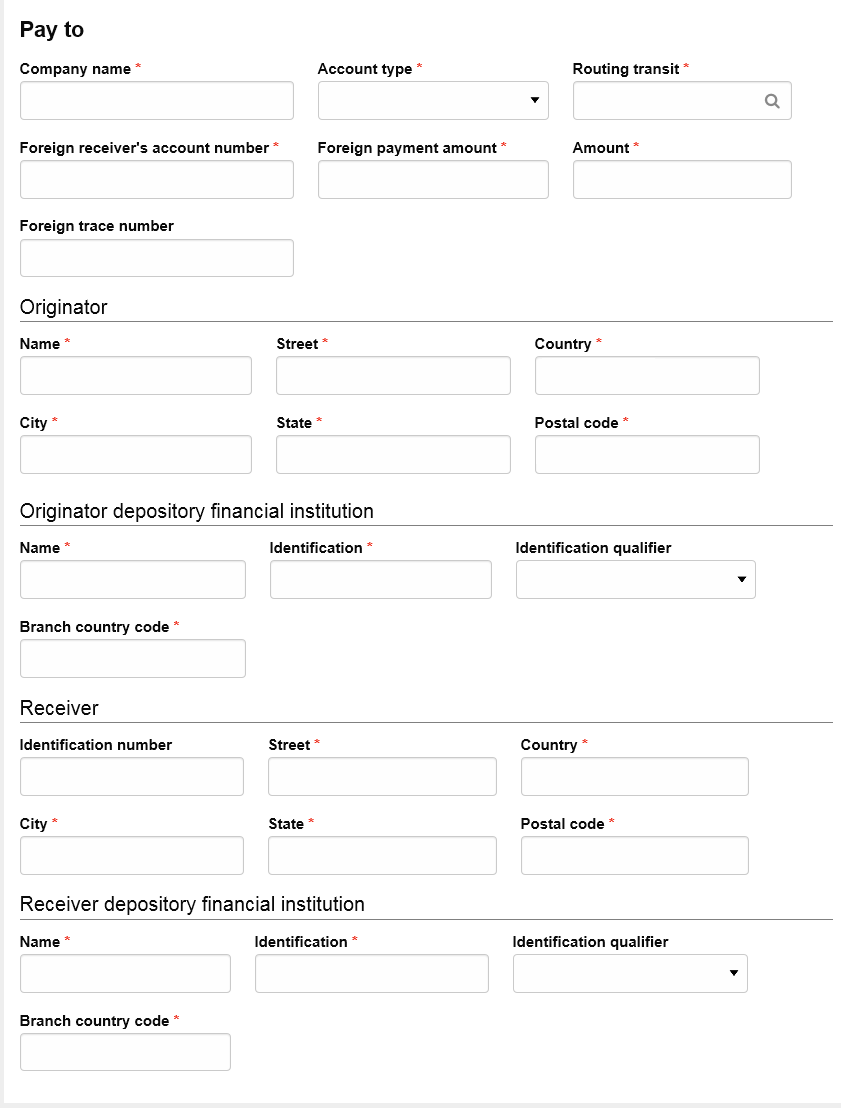

Pay To

Company

The company name that the system associates with the ACH file.

Account type

The account ![]() type from which the system credits funds to.

type from which the system credits funds to.

|

Select Account Type |

indicates that you need to select an account type (Default) |

|

Checking |

indicates that the system credits the funds to a demand deposit account |

|

Savings |

indicates that the system credits the funds to a savings account |

|

Loan |

indicates that the system credits the funds to a loan account |

|

General Ledger |

indicates that the system credits the funds to a general ledger account |

Routing transit

The routing transit number that identifies the institution.

Foreign receiver's account number

For outbound IAT entries, the full account number of the account held by the foreign receiver. For inbound IAT entries, the full account number of the account held by the domestic receiver.

Foreign payment amount

For inbound IAT entries, the Foreign payment amount is the amount for which the entry was originated in the foreign ODFI in the currency denomination expressed in the ISO Originating Currency Code of the transfer. For outbound IAT entries originated using the Indicator of Fixed to Variable Conversion, the Foreign payment amount is zero.

For outbound IAT entries using an Indicator of Variable to Fixed Conversion or Fixed to Fixed Conversion, the Foreign payment amount is the amount for which the entry is to be received by the foreign receiver in the currency denomination expressed in the ISO Destination Currency Code of the transfer.

For inbound IAT entries by a domestic RDFI, the Foreign payment amount is copied from the original entry detail record to the entry detail record for IAT returns. For outbound IAT entries returned by a domestic originating gateway operator, the Foreign payment amount contains the entry amount returned to the original ODFI. This amount may differ from the original entry amount if the same was not used for both forward and return entry foreign exchange conversions.

Amount

The amount to be paid to the account that you specify.

Foreign trace number

The trace number that the system assigns to the entry in the originating national payments system for inbound IAT entries.

Originator

Name

The name of the originator for the International ACH (IAT) entry.

Street

The street address of the originator for the International ACH (IAT) entry.

Country

The country of the originator for the International ACH (IAT) entry.

City

The city of the originator for the International ACH (IAT) entry.

State

The state or providence of the originator for the International ACH (IAT) entry.

Postal code

The postal code of the originator for the International ACH (IAT) entry.

Originator Depository Financial Institution

Name

The name of the Originating Depository Financial Institution (ODFI).

Identification

The ODFI identification number that uniquely identifies the institution; usually the institution's routing transit number. For inbound IAT entries, the Identification is the National Clearing System Number of the foreign ODFI. For outbound IAT entries, the Identification is the routing transit number of the domestic ODFI.

Identification qualifier

The ![]() code that identifies the numbering scheme used in the Originator Depository Financial Institution (DFI) Identification number field in the Transfer To section.

code that identifies the numbering scheme used in the Originator Depository Financial Institution (DFI) Identification number field in the Transfer To section.

|

01 |

indicates the National Clearing System Number |

|

02 |

indicates the Bank Identifier Code |

|

03 |

indicates the International Bank Account Number |

Branch country code

The code approved by the International Organization for Standardization (ISO) used to identify the country of the branch from which the IAT entry is originated.

Receiver

Identification number

The number that identifies the receiver, usually by the routing transit number for tracing purposes.

Street

The street address of the receiver for the International ACH (IAT) entry.

Country

The country of the receiver for the International ACH (IAT) entry.

City

The city of the receiver for the International ACH (IAT) entry.

State

The state or providence of the receiver for the International ACH (IAT) entry.

Postal code

The postal code of the receiver for the International ACH (IAT) entry.

Receiver Depository Financial Institution

Name

The name of the Receiving Depository Financial Institution (RDFI).

Identification

The RDFI identification number that uniquely identifies the institution; usually the institution's routing transit number. For inbound IAT entries, the Receiving DFI Identification is the National Clearing System Number of the foreign ODFI. For outbound IAT entries, the Receiving DFI Identification is the routing transit number of the domestic ODFI.

Identification qualifier

The ![]() code that identifies the numbering scheme used in the RDFI Identification number field.

code that identifies the numbering scheme used in the RDFI Identification number field.

|

01 |

indicates the National Clearing System Number |

|

02 |

indicates the Bank Identifier Code |

|

03 |

indicates the International Bank Account Number |

Branch country code

The code approved by the International Organization for Standardization (ISO) used to identify the country of the branch which receives the IAT entry.

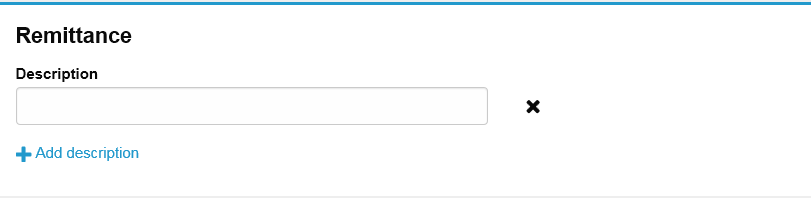

Remittance

Description

The description for the remittance.

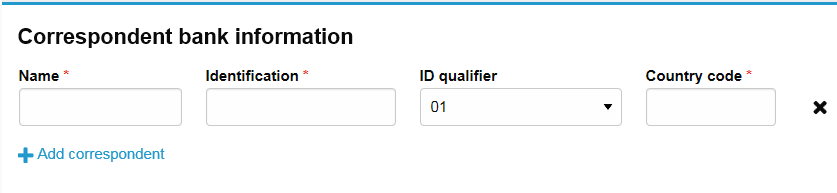

Correspondent Bank Information

Name

The name of the correspondent institution.

Identification

The routing transit number or institution identification number of the correspondent institution.

ID qualifier

The code that identifies the numbering scheme used in the Identification field.

Country code

The code approved by the International Organization for Standardization (ISO) used to identify the country where the branch of the correspondent institution is located.

State/local Tax Payment

State/local taxes are one of the ACH transfer types that are available for use by financial institution users and their clients. Financial institution users and their clients can generate and manage state and local tax payment ACH transfer types using the standard the ACH User Interface functions.

Transfer Overview

The transfer overview is always the first block of information that the system presents when you view an ACH transfer. It contains header information that provides a description of the transfer name (for example, New ACH - State/local taxes - CCD) and a number of fields that communicate basic information about the transfer such as the name, the effective date, and the total debit amount.

Description

The Description ![]() field appears on every ACH transfer that you generate or import.

field appears on every ACH transfer that you generate or import.

The system uses it to attach a name or description to the transfer that is recognizable to the submitter. For example, a federal tax payment transfer submitted by John Adams or on behalf of John Adams might utilize the verbiage "JAdams State Corp Tax".

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

State

The ![]() state name of the tax agency. States that are suppressed do not display in the New ACH - State/Local Tax Payment section. ACH administrative users can suppress or add states as needed.

state name of the tax agency. States that are suppressed do not display in the New ACH - State/Local Tax Payment section. ACH administrative users can suppress or add states as needed.

|

Alabama |

Hawaii |

Massachusetts |

New Mexico |

South Dakota |

|

Alaska |

Idaho |

Michigan |

New York |

Tennessee |

|

Arizona |

Illinois |

Minnesota |

North Carolina |

Texas |

|

Arkansas |

Indiana |

Mississippi |

North Dakota |

Utah |

|

California |

Iowa |

Missouri |

Ohio |

Vermont |

|

Colorado |

Kansas |

Montana |

Oklahoma |

Virginia |

|

Connecticut |

Kentucky |

Nebraska |

Oregon |

Washington |

|

Delaware |

Louisiana |

Nevada |

Pennsylvania |

West Virginia |

|

Florida |

Maine |

New Hampshire |

Rhode Island |

Wisconsin |

|

Georgia |

Maryland |

New Jersey |

South Carolina |

Wyoming |

If the state is Pennsylvania, the Company ID field also appears, indicating the code of the company associated with the transfer.

Effective date

The Effective date ![]() field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

You can enter the effective date in a number of ways:

-

Type the date with forward slashes to differentiate between day, month, and year. For example, type May 5, 2015 as 05/15/2015.

-

Click

and then selecting the date you want to serve as the effective date for the transfer.

and then selecting the date you want to serve as the effective date for the transfer.

-

In the event that you enter a date that is not a valid processing day, the user interface displays a warning message indicating that the date you selected is not a valid processing day and the system automatically selects the next available processing date. If this warning message appears, click Process ACH or Save for later or enter a new Effective date.

Same day

Select the Same day check box to assign the specified transfer as same day transfer. When you select the Same day check box, the system enters today's date as the Effective date and you cannot modify the Effective date.

Repeat

Select the Repeat check box to establish the frequency, the date that the recurring transfer ends, and which processing day the system uses when the date falls on a nonprocessing date.

Frequency

Indicates the ![]() frequency that the recurring transfer occurs.

frequency that the recurring transfer occurs.

|

Daily |

indicates the recurring transfer occurs daily |

|

Weekly |

indicates the recurring transfer occurs weekly |

|

Every two weeks |

indicates that the recurring transfer occurs every two weeks |

|

Monthly |

indicates the recurring transfer occurs monthly |

|

End of month |

indicates the recurring transfer occurs at the end of the month |

|

Every two months |

indicates the recurring transfer occurs every two months |

|

Quarterly |

indicates the recurring transfer occurs quarterly |

|

Every six months |

indicates the recurring transfer occurs every six months |

|

Annually |

indicates the recurring transfer occurs annually |

End date

The date the originator intends the recurring transfer cycle to end. Type the date (mm/dd/yyyy) that you want the recurring transfer cycle to end or click ![]() to select the date you want the recurring transaction cycle to end.

to select the date you want the recurring transaction cycle to end.

From account

The account associated with the company or user at the Originating Depository Financial Institution (ODFI) that is submitting the Federal Tax payment. For example, Washington Orchards DDA.

Total payment

The total dollar amount of the federal tax payment submitted for processing.

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

Payments

What makes the State/Local Tax Payment ACH transfer type unique, is the state/local tax payment information that populates the Payments section. This section contains fields that are unique to state or local tax payments and are not found in any other ACH transfer type. The following fields populate the Payments section.

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Name

The name of the recipient of the federal tax payment at the Receiving Depository Financial Institution (RDFI). By default, the ACH User Interface populates this field with the value IRS.

Tax description

A list of state and local tax payments and their associated tax type codes. Selections made from this drop-down list populate the Amount field with the numeric tax type code values denoting the type of tax payment that is being submitted.

Tax period end date

The last ![]() day of the tax period.

day of the tax period.

The transfer's tax period end date can be entered in a number of ways:

-

Entering the date without any forward slashes to differentiate between day, month, and year. For example, 05052015 to represent May 5, 2015. When you enter an effective date in this manner, the ACH User Interface updates the field to display the date with forward slashes (for example, 05052015 becomes 05/15/2015).

-

Entering the date with forward slashes to differentiate between day, month, and year. For example, May 5, 2015 would be entered as 05/15/2015.

-

Selecting the

icon and then selecting the date you want to serve as the effective date for the transfer.

icon and then selecting the date you want to serve as the effective date for the transfer.

Taxpayer

Identification

The tax identification number of the account owner at the Originating Depository Financial Institution (ODFI) that is submitting the federal tax payment.

Verification

The entry required by some institutions for verifying the tax payer (typically, the first six letters of the company name).

The Verification field displays only if this optional item was completed in the original template.

Account

The account number of the state or local tax agency.

Routing transit

The routing transit number of the state or local tax agency.

Tax Amount 1 (2 and 3)

Amount

The amount of the tax payment that is submitted. You can remove tax amounts and the associated Amount, Type, and Type description fields from a federal tax payment by clicking ![]() for the tax amount row you want to delete.

for the tax amount row you want to delete.

Type

The amount type. The number of Type fields that the system displays is determined by the selected state and tax description. Some states require more amount types than others, and some prefill the types and descriptions while others do not.

Type description

The description of the associated Type.

Add payment

You can add additional tax payments to a state/local tax payment transfer by selecting the Add payment hyperlink. You can delete tax payments from a transfer by clicking ![]() on the Payment Details caption bar.

on the Payment Details caption bar.

See Also:

Back to Top