Import ACH Transfers

You can utilize the import functionality to import NACHA and Non-NACHA formatted transfers. In addition, the import functionality enables you to utilize existing ACH templates to validate information present in an import file.

The following sections display on this page:

Template Details and Field Definitions

NACHA Formatted Transfers

NACHA formatted transfers are represented by transfers established from files, including templates that conform to the standard format as defined by Federal Reserve in the NACHA ACH File Exchange specifications. When you initiate the import functionality, the ACH User Interface launches a wizard that proceeds through several steps that contain fields and options that you must specify prior to submitting the file for processing. You can import NACHA formatted transfer files with or without the use of an existing NACHA template.

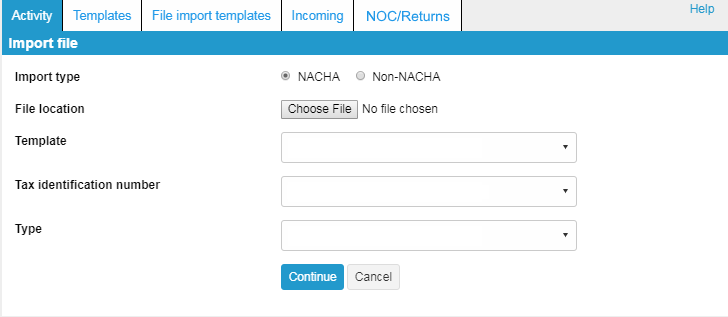

Import File

The Import file page enables you to define the fields that the system requires for importing a NACHA formatted transfer file.

|

| Define all the appropriate fields to import a NACHA file. |

Import type

Indicates whether the import file is a NACHA or Non-NACHA file.

File location

The directory path where ACH transfer files, correctly formatted and containing stored values, are located for import. To select a file for import, click Browse, navigate to the appropriate folder directory and select the ![]() transfer file for import.

transfer file for import.

The selected file must be in the correct format for the import type or the ACH User Interface displays the message, "Invalid record type in file" and stops the import process. To continue, click Browse and select a file formatted to match the import type.

Template

The ![]() template against which the system validates the imported transfer file. The list contains only those templates matching the current import type to which the current user has access. If the ACH user does not have access to any templates, the system does not display the Template field.

template against which the system validates the imported transfer file. The list contains only those templates matching the current import type to which the current user has access. If the ACH user does not have access to any templates, the system does not display the Template field.

Selecting an established template in the Template drop-down list automatically populates the Tax identification number and Transfer type fields, and displays the Amount range field when the range is defined in the template.

If the template that you select contains required fields (for example, Required Funding Transactions) whose values are missing from the selected transfer file, the ACH User Interface displays the message, "File is not as per the selected format".

The system displays the Template field only if the current user has access to at least one stored NACHA template.

Tax identification number

The tax identification number of the account owner at the Originating Depository Financial Institution (ODFI). This field populates as a drop-down list in the event there are multiple companies that the system associates with a given account holder. For example, George Washington is tied to accounts servicing Washington Orchards and Washington Agricultural Group, Inc. Subsequently, the tax identification numbers that the system associates with Washington Orchards and Washington Agricultural Group, Inc. populate the Tax Identification Number.

Type

The Type field appears as a drop-down list from which you can select the ![]() type of transfer that you want to import.

type of transfer that you want to import.

Payment

Payroll - PPD

indicates a payroll transfer that originates from an account at an employer's financial institution and is deposited to an account at an employee’s financial institution

Prearranged deposit - PPD

indicates a prearranged deposit transfer credit application that transfers funds into a consumer’s account at the Receiving Depository Financial Institution (RDFI)

Health savings contribution - PPD

indicates a Health Savings Account (HSA) contribution transfer

Company - CCD

indicates a business to business transaction in which the system transfers funds from one organization to another. In this case, the originator receives an authorization from the receiver, giving the originator permission to send a debit entry to their business account.

Individual - CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are credit entry initiated by or on behalf of the holder of a consumer account to the non-consumer account of a receiver.

Vendor - CCD

indicates a payment for an invoice received by a corporate client

Remittance - CCD

indicates a transfer from a consumer in the United States to a recipients abroad. These recipients may include friends, family members or businesses.

Federal taxes - CCD

indicates a tax payment intended for submission to the United States Internal Revenue Service (IRS)

State/local taxes- CCD

indicates a tax payment intended for submission to one or more State or local tax agencies. For example, the submission of a Corporate Estimated Income tax payment to the Nebraska Department of Revenue.

Corporate trade exchange - CTX

the Corporate Trade Exchange application supports the transfer of funds (debit or credit) within a trading partner relationship in which a full ANSI ASC X12 message or payment related UN/EDIFACT information is sent with the funds transfer. The ANSI ASC X12 message or payment related UN/EDIFACT information is placed in multiple addenda records.

Customer initiated - CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are typically credit only transfers where the consumer initiates the transfer of the funds.

Child support agency - CCD

indicates a child support payment

International - IAT

international ACH transactions are used for the transmission of International cross-border credit and debit ACH entries

Collection

Prearranged payment - PPD

indicates a prearranged payment transfer debit application. For example, monthly payments of household utility bills can be collected using this transfer type.

Company - CCD

indicates a business to business transaction in which the system transfers funds from one organization to another. In this case, the originator receives an authorization from the receiver, giving the originator permission to send a credit entry to their business account.

Individual- CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are credit entry initiated by or on behalf of the holder of a consumer account to the non-consumer account of a receiver.

Re-presented check - RCK

indicates a re-presented check transfer, which involves a single ACH debit used by originators to re-present a check processed through the check collection system and returned due to insufficient or uncollected funds

Internet authorized - WEB

the internet initiated entry type is used for the origination of debit entries (recurring or single) to a consumer's account based on an authorization that is obtained by the receiver via the internet

Telephone authorized - TEL

the telephone initiated entry is used for the origination of a single debit entry transaction to a consumer’s account in accordance with an oral authorization obtained from the consumer via the telephone

Other

Commingled File

commingled files are comprised of more than one ACH transfer type

ACH Pass-Thru

indicates a NACHA formatted transfer file that you imported into the ACH User Interface. The batches that populate the NACHA formatted transfer file may be any of the transfer types defined in the previous rows of the table. The ACH Pass-Thru Transfer Type enables financial institution clients or financial institution administrative users to indicate how the system handles individual batches once you submit a NACHA formatted transfer file for processing.

The Commingled File and ACH Pass-Thru transfer types are available only when importing a NACHA transfer without a template.

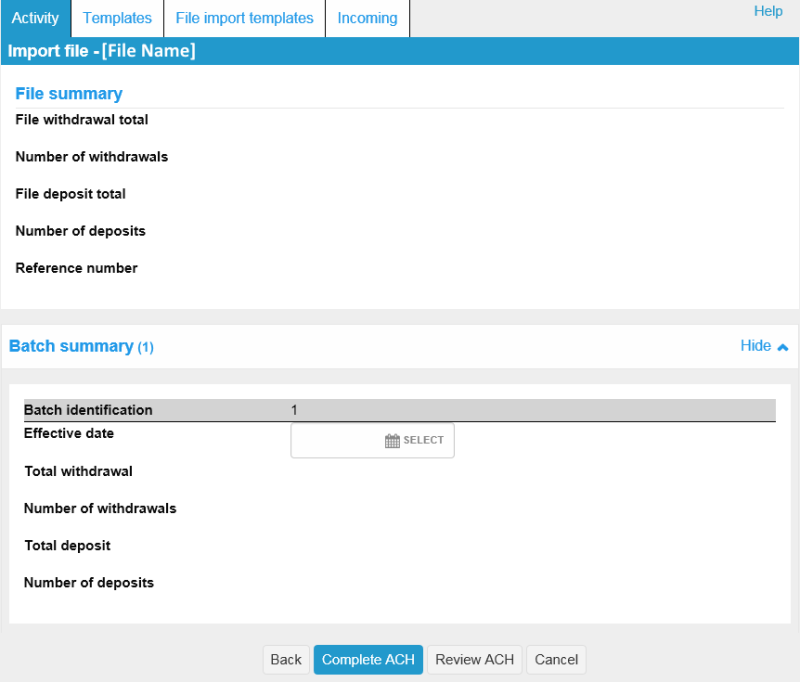

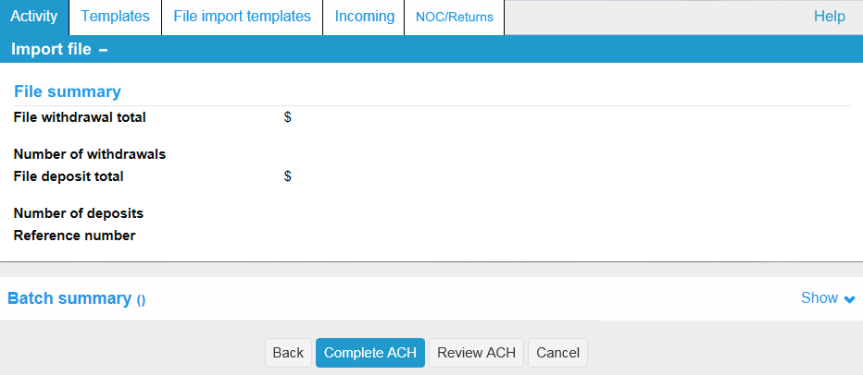

File Summary

Once the file import selections are made for the ACH Pass-Thru file that is being imported, select Submit to execute the import process. When the import process completes, the ACH User Interface populates the ![]() processing results page with information related to the batches that you selected for processing and the batches that you selected for saving.

processing results page with information related to the batches that you selected for processing and the batches that you selected for saving.

The information populating the processing results page includes the following elements:

|

Section |

Description |

|---|---|

|

File withdrawal total |

The total amount of the file withdrawals |

|

Number of withdrawals |

The total number of withdrawals |

|

File deposit total |

The total amount of the file deposits |

|

Number of deposits |

The total number of deposits |

|

Reference number |

The unique identifier that the system generates during the import process. You can use the identifier to search for the imported file once the system completes the import process. |

|

Batch Summary |

|

|

Effective date |

The date placed on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place |

|

Total withdrawal |

The total amount of withdrawals for the ACH batch |

|

Number of withdrawals |

The total number of withdrawals for the ACH batch |

|

Total deposit |

The total amount of deposits for the ACH batch |

|

Number of deposits |

The total number of deposits for the ACH batch |

|

| The File summary page provides a quick overview of the imported file. |

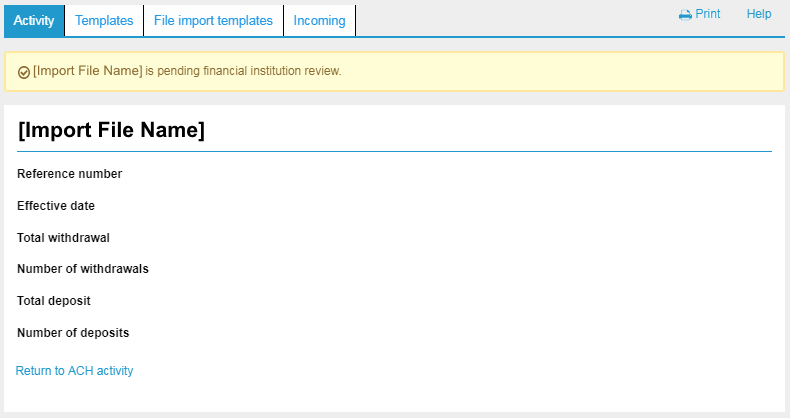

Confirmation

|

Section |

Description |

|---|---|

|

Reference number |

The unique identifier that the system generates during the import process. You can use the identifier to search for the imported file once the system completes the import process. |

|

Effective date |

The date placed on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place |

|

Total withdrawal |

The total amount of withdrawals for all ACH batches that you imported |

|

Number of withdrawals |

The total number of withdrawals for all ACH batches that you imported |

|

Total deposit |

The total amount of deposits for all ACH batches that you imported |

|

Number of deposits |

The total number of deposits for all ACH batches that you imported |

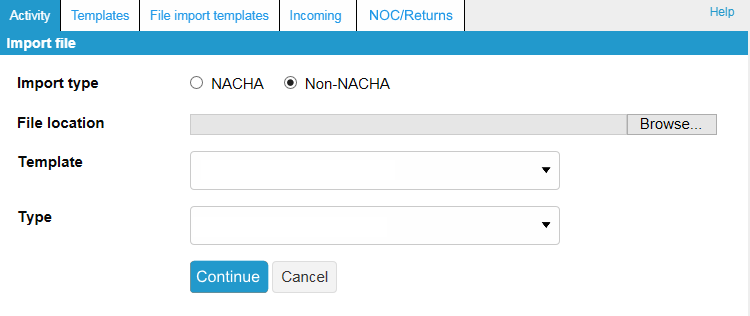

Non-NACHA Formatted Transfers

File Selection

Once you initiate the file import process, the system populates the user interface with the first of several steps that are required to successfully import a Non-NACHA formatted ACH transfer. The fields that display are governed by the user's association with any established ACH transfer templates.

Import type

Indicates whether the import file is a NACHA or Non-NACHA file.

File location

The directory path where ACH transfer files, correctly formatted and containing stored values, are located for import. To select a file for import, click Browse, navigate to the appropriate folder directory and select the ![]() transfer file for import.

transfer file for import.

The selected file must be in the correct format for the import type or the ACH User Interface displays the message, "Invalid record type in file" and stops the import process. To continue, click Browse and select a file formatted to match the import type.

Template

The ![]() template against which the system validates the imported transfer file. The list contains only those templates matching the current import type to which the current user has access. If the ACH user does not have access to any templates, the system does not display the Template field.

template against which the system validates the imported transfer file. The list contains only those templates matching the current import type to which the current user has access. If the ACH user does not have access to any templates, the system does not display the Template field.

Selecting an established template in the Template drop-down list automatically populates the Tax identification number and Transfer type fields, and displays the Amount range field when the range is defined in the template.

If the template that you select contains required fields (for example, Required Funding Transactions) whose values are missing from the selected transfer file, the ACH User Interface displays the message, "File is not as per the selected format".

The system displays the Template field only if the current user has access to at least one stored NACHA template.

Type

The Type field appears as a drop-down list from which you can select the ![]() type of transfer that you want to import.

type of transfer that you want to import.

Payment

Payroll - PPD

indicates a payroll transfer that originates from an account at an employer's financial institution and is deposited to an account at an employee’s financial institution

Prearranged deposit - PPD

indicates a prearranged deposit transfer credit application that transfers funds into a consumer’s account at the Receiving Depository Financial Institution (RDFI)

Health savings contribution - PPD

indicates a Health Savings Account (HSA) contribution transfer

Company - CCD

indicates a business to business transaction in which the system transfers funds from one organization to another. In this case, the originator receives an authorization from the receiver, giving the originator permission to send a debit entry to their business account.

Individual - CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are credit entry initiated by or on behalf of the holder of a consumer account to the non-consumer account of a receiver.

Vendor - CCD

indicates a payment for an invoice received by a corporate client

Remittance - CCD

indicates a transfer from a consumer in the United States to a recipients abroad. These recipients may include friends, family members or businesses.

Federal taxes - CCD

indicates a tax payment intended for submission to the United States Internal Revenue Service (IRS)

State/local taxes- CCD

indicates a tax payment intended for submission to one or more State or local tax agencies. For example, the submission of a Corporate Estimated Income tax payment to the Nebraska Department of Revenue.

Corporate trade exchange - CTX

the Corporate Trade Exchange application supports the transfer of funds (debit or credit) within a trading partner relationship in which a full ANSI ASC X12 message or payment related UN/EDIFACT information is sent with the funds transfer. The ANSI ASC X12 message or payment related UN/EDIFACT information is placed in multiple addenda records.

Customer initiated - CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are typically credit only transfers where the consumer initiates the transfer of the funds.

Child support agency - CCD

indicates a child support payment

International - IAT

international ACH transactions are used for the transmission of International cross-border credit and debit ACH entries

Collection

Prearranged payment - PPD

indicates a prearranged payment transfer debit application. For example, monthly payments of household utility bills can be collected using this transfer type.

Company - CCD

indicates a business to business transaction in which the system transfers funds from one organization to another. In this case, the originator receives an authorization from the receiver, giving the originator permission to send a credit entry to their business account.

Individual- CIE

indicates a variant of the Customer Initiated Entry (CIE) transfer. Customer Initiated Entry (CIE) transfers are credit entry initiated by or on behalf of the holder of a consumer account to the non-consumer account of a receiver.

Re-presented check - RCK

indicates a re-presented check transfer, which involves a single ACH debit used by originators to re-present a check processed through the check collection system and returned due to insufficient or uncollected funds

Internet authorized - WEB

the internet initiated entry type is used for the origination of debit entries (recurring or single) to a consumer's account based on an authorization that is obtained by the receiver via the internet

Telephone authorized - TEL

the telephone initiated entry is used for the origination of a single debit entry transaction to a consumer’s account in accordance with an oral authorization obtained from the consumer via the telephone

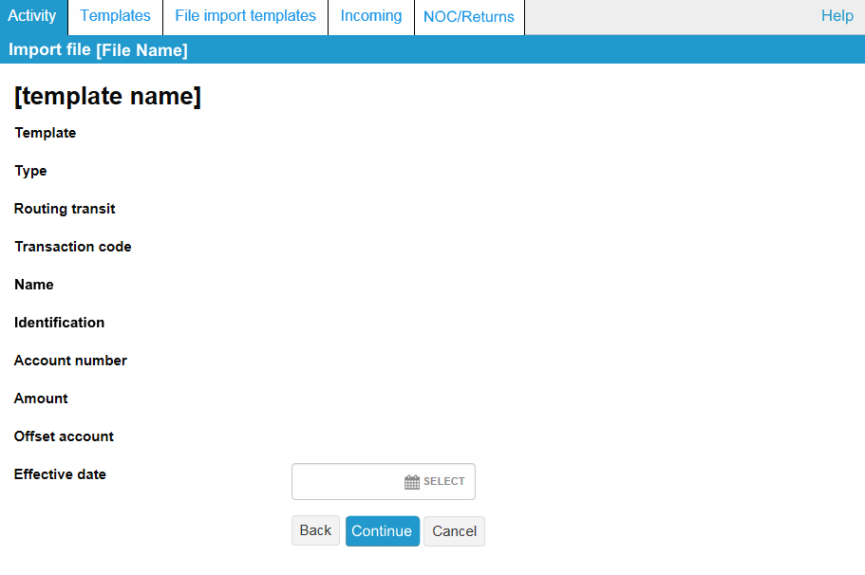

Template Details and Field Definitions

Once you select a Non-NACHA file for import, you can assign identification attributes to the file, define the type of file being imported and specify which users that the system authorizes to access the transfer file.

Template name

The name of the template.

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

Template group

The template group to which the template belongs.

Type

The ACH transfer type that you are importing (for example, Payroll - PPD)

Insert decimal into amounts

Indicates whether the system inserts a ![]() decimal into the amount.

decimal into the amount.

|

Yes |

indicates that the system inserts the decimal to the right most digits of an amount |

|

No |

indicates that the system does not insert the decimal |

File Format

The system automatically populates additional information in the File format section such as Delimited (and associated type) or Fixed width, Header and Footer rows to exclude, and any Text qualifier (if there is one). You can edit these fields as necessary.

Delimited

Indicates the imported file format is Delimited. If you select the Delimited option, you can further specify the type of delimited ![]() format that the imported file uses.

format that the imported file uses.

|

Tab |

indicates that the file delimiter is a tab |

|

Semicolon |

indicates that the file delimiter is a semicolon |

|

Comma |

indicates that the file delimiter is a comma |

|

Space |

indicates that the file delimiter is a space |

|

Other |

indicates that the file delimiter is other than a space |

Fixed width

Indicates that every field in the template has a fixed, defined width, with shorter values being padded with characters. Selecting this option overrides any selections in the Delimited field, as files are either delimited or fixed width.

Number of rows to exclude

Header

The number of header rows at the beginning of the file that the system excludes during file import.

Footer

The number of footer rows at the end of the file that the system excludes during file import.

Text qualifier

Indicates whether the ![]() text fields are defined by single quote marks (') or double quote marks (") for the purpose of grouping pieces of data together (for example, "Adams, John"). The Text qualifier helps you to know which pieces of data need to be kept together and not separated. You can only use the Text qualifier in conjunction with a Delimited file.

text fields are defined by single quote marks (') or double quote marks (") for the purpose of grouping pieces of data together (for example, "Adams, John"). The Text qualifier helps you to know which pieces of data need to be kept together and not separated. You can only use the Text qualifier in conjunction with a Delimited file.

|

None |

indicates that the file does not need a text qualifier. |

|

Double quote - " |

indicates that the file uses double quotes to group pieces of data together |

|

Single quote - ' |

indicates that the file uses single quotes to group pieces of data together |

File preview

The preview of the ACH file format.

If any value that the system requires for the selected ACH transfer type is not defined in the imported ACH file, then you need to be define it in the Apply Additional Values to File section. The Apply Additional Values to File section may display below the File Preview section as it depends on the type of file that you are being importing.

Mapping preview

The preview of the fields that are mapped.

Apply additional values

If any value required for the selected ACH transfer type is not defined in the imported ACH file, it needs to be defined in the Apply Additional Values to File section. The Apply Additional Values to File section may display below the File Preview section as it depends on the type of file being imported.

Type

Indicates that a ![]() type of value that you want to add to the imported Non-NACHA file. The system marks required fields with an asterisks (*).

type of value that you want to add to the imported Non-NACHA file. The system marks required fields with an asterisks (*).

|

(None) |

indicates that you do not need additional values |

|

Account number |

indicates that you want to add the account number |

|

Amount |

indicates that you want to add the amount |

|

Discretionary data |

indicates that you want to add discretionary data |

|

Effective date |

indicates that you want to add the effective date |

|

Employee ID |

indicates that you want to include the employee ID |

|

Employee name |

indicates that you want to include the employee name |

Value

The value of the type that you specify.

Offset account options

Offset Account Defined In File

Indicates whether the offset account is defined within the import file.

Select Account

Indicates the list of accounts that a user has access to.

Effective date options

Date in file

Indicates whether the effective date is defined within the import file.

Prompt for date

Indicates whether the system prompts the ACH user for the effective date during the file import process.

Default current business date

Indicates whether the system adds the current business date into the file during the import process.

User access

ACH users that have ![]() access to view, inquire, change, and delete the template, as well as review transfers originated using the template. The User Access settings also control who can import files using the template.

access to view, inquire, change, and delete the template, as well as review transfers originated using the template. The User Access settings also control who can import files using the template.

|

All current and future users |

indicates that all users have access to the template and transfers that are imported using the template, including future users |

|

Specific users |

indicates that only users selected in this section have access to the template and transfers that are imported using the template |

You must manually select new employees that are added to the company after you establish the template by changing the template before they have access to the template or transfers that were established from the template.

Data Mapping

Once the system assigns each piece of data in the Non-NACHA file a data type, Step 4 – Data Mapping provides an overview and confirmation that the data will be mapped. In the event that a data type is incorrectly assigned, the system displays an error message. You can click Back to make any necessary edits.

Transfer Details Review

If the system imports the data successfully, a confirmation box appears listing the File withdrawal total, Number of withdrawals, File deposit total, Number of deposits and Reference Number.

See Also:

Import a NACHA File Without Using a Template

Import a NACHA File Using an Existing Template

Import a Non-NACHA File Using an Existing Template

Import a Non-NACHA File Using a New Template

Back to Top