ACH Transfers – Common Fields

The ACH User Interface Program extends your ability to generate, import, edit, review, approve, and delete NACHA and Non-NACHA formatted ACH transfers. When you are working with ACH transfers there are certain fields that apply across most of the ACH transfer types. Subsequently, the majority of the ACH transfer types that you generate or import populate the user interface in the same fashion regardless of the activity you are undertaking.

There are four ACH transfer types with unique layouts and fields that we document in the ACH Transfers - Unique Fields page. The four unique ACH transfer types are:

For all the other ACH transfer types, the following sections display on this page:

Transfer overview

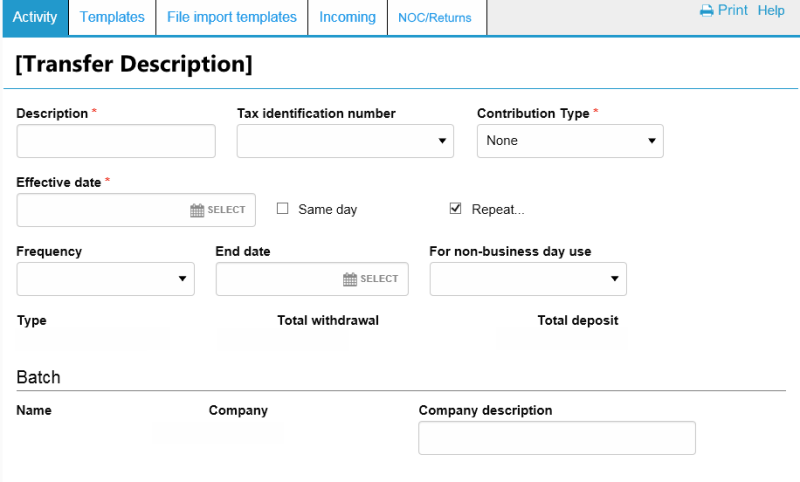

The transfer overview section is always the first block of information that the system presents when you view an ACH transfer. It contains some header information that provides a description of the transfer name (for example, New ACH - Payroll (PPD)) and a number of fields that communicate basic information about the transfer such as the name, the effective date, and the total debit amount.

ACH - [Transfer Description]

Description

The Description ![]() field appears on every ACH transfer that you generate or import.

field appears on every ACH transfer that you generate or import.

You can type up to 30 alpha, numeric or special characters. You can use this field to attach a name or description to the transfer that is recognizable to the submitter. For example, Washington Orchards submits a payroll transfer and uses the description "Wash Orch SEP Payroll."

Tax identification number

The combination of the company name and tax ID of the user. If the system associates the user with more than one company, then the Tax identification number lists all the companies that the system associates with the user.

Contribution type

Health Savings Contributions Only. Indicates whether the employee or employer are ![]() making a health savings contribution.

making a health savings contribution.

|

None |

indicates no contribution is made to the health savings account |

|

Employee |

indicates that the employee is making the contribution to the health savings account |

|

Employer |

indicates that the employer is making the contribution to the health savings account |

Effective date

The Effective date ![]() field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

field appears on every ACH transfer that you generate or import. The system places this date is on an ACH transfer by the originator (user or financial institution) and is normally the date the originator intends the transfer to take place.

You can enter the effective date in a number of ways:

-

Type the date with forward slashes to differentiate between day, month, and year. For example, type May 5, 2015 as 05/15/2015.

-

Click

and then selecting the date you want to serve as the effective date for the transfer.

and then selecting the date you want to serve as the effective date for the transfer.

-

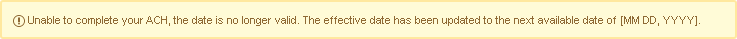

In the event that you enter a date that is not a valid processing day, the user interface displays a warning message indicating that the date you selected is not a valid processing day and the system automatically selects the next available processing date. If this warning message appears, click Process ACH or Save for later or enter a new Effective date.

Same day

Select the Same day check box to assign the specified transfer as same day transfer. When you select the Same day check box, the system enters today's date as the Effective date and you cannot modify the Effective date.

Repeat

Select the Repeat check box to establish the frequency, the date that the recurring transfer ends, and which processing day the system uses when the date falls on a nonprocessing date.

Frequency

Indicates the ![]() frequency that the recurring transfer occurs.

frequency that the recurring transfer occurs.

|

Daily |

indicates the recurring transfer occurs daily |

|

Weekly |

indicates the recurring transfer occurs weekly |

|

Every two weeks |

indicates that the recurring transfer occurs every two weeks |

|

Monthly |

indicates the recurring transfer occurs monthly |

|

End of month |

indicates the recurring transfer occurs at the end of the month |

|

Every two months |

indicates the recurring transfer occurs every two months |

|

Quarterly |

indicates the recurring transfer occurs quarterly |

|

Every six months |

indicates the recurring transfer occurs every six months |

|

Annually |

indicates the recurring transfer occurs annually |

End date

The date the originator intends the recurring transfer cycle to end. Type the date (mm/dd/yyyy) that you want the recurring transfer cycle to end or click ![]() to select the date you want the recurring transaction cycle to end.

to select the date you want the recurring transaction cycle to end.

For non-business day use

Indicates whether the system ![]() uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

uses the next business day or the previous business day to process transactions that are scheduled on a non-business day.

|

Next business day |

indicates that the system uses the next business day to process transactions that are scheduled on a non-business day. |

|

Previous business day |

indicates the system uses the previous business day to process transactions that are scheduled on a non-business day. |

Type

The ACH transfer ![]() type for the specified transfer or template.

type for the specified transfer or template.

|

Payments |

|

|

Payroll - PPD |

indicates a payroll transfer that originates from an account at an employer's financial institution and a payment is made to an account at an employee’s financial institution |

|

Prearranged deposit - PPD |

indicates a prearranged deposit transfer credit application that transfers funds into a consumer’s account at the Receiving Depository Financial Institution (RDFI) |

|

Heath savings contribution - PPD |

indicates a Health Savings Account (HSA) contribution transfer |

|

Company -CCD |

indicates a business to business transfers in which the system transfers funds from one organization to another. In this case, the originator receives an authorization from the receiver, giving the originator permission to send a credit entry to their business account. |

|

Individual - CIE |

indicates a for Customer Initiated Entry (CIE) transfer which are credit entries initiated by or on behalf of the holder of a consumer account to the nonconsumer account of a receiver |

|

Remittance - CCD |

indicates a transfer from a consumer in the United States to a recipients abroad. These recipients may include friends, family members, or businesses. |

|

Vendor - PPD |

indicates a payment for an invoice received by a corporate client |

|

Federal taxes - CCD |

indicates a tax payment intended for submission to the United States Internal Revenue Service (IRS) |

|

State/local taxes - CCD |

indicates a tax payment intended for submission to one or more state or local tax agencies. For example, the submission of a Corporate Estimated Income tax payment to the Nebraska Department of Revenue. |

|

Corporate trade exchange - CTX |

indicates a Corporate Trade Exchange transfer which supports the transfer of funds (debit or credit) within a trading partner relationship in which a full ANSI ASC X12 message or payment related UN/EDIFACT information is sent with the funds transfer. |

|

Customer initiated entry -CIE |

indicates a Customer Initiated Entry (CIE) transfer which are typically credit only transfers where the consumer initiates the transfer of the funds |

|

Child support agencies - CCD |

indicates a child support payment |

|

International - IAT |

indicates an international ACH transfer, which are used for the transmission of International cross-border credit and debit ACH entries |

|

Prearranged payment - PPD |

indicates a prearranged payment transfer debit application. For example, monthly payments of household utility bills can be collected using this transfer type. |

|

Re-presented check - RCK |

indicates a re-presented check transfer, which involves a single ACH debit used by originators to re-present a check processed through the check collection system and returned due to insufficient or uncollected funds |

|

Internet authorized - WEB |

indicates a transfer that was an internet initiated entry type which is used for the origination of debit entries (recurring or single) to a consumer's account based on an authorization that is obtained by the receiver using the internet |

|

Telephone authorized - TEL |

indicates a transfer that is identified as a the telephone initiated entry, which is the result of the origination of a single debit entry transfer to a consumer’s account in accordance with an oral authorization obtained from the consumer using the telephone |

|

Commingled |

indicates a commingled file (that is to say, transfers that are comprised of more than one ACH transfer type) |

|

Pass-thru |

indicates a pass-thru transfer |

|

Reversal |

indicates a reversal transfer |

Total withdrawal

The total amount that the system debits from the account at the Originating Depository Financial Institution (ODFI).

Total deposits

The total amount that the system credits to the account at the Receiving Depository Financial Institution (RDFI). For ACH Incoming transfers, payments are made to the on-us account and withdrawals are made against the account at the Receiving Depository Financial Institution (RDFI).

Batch

Name

The name of the batch.

Company

The company name that the system associates with the ACH file.

Company description

A client-defined entry description that describes the purpose or intent of the transaction (for example, Gas bill). The maximum number of characters is 10.

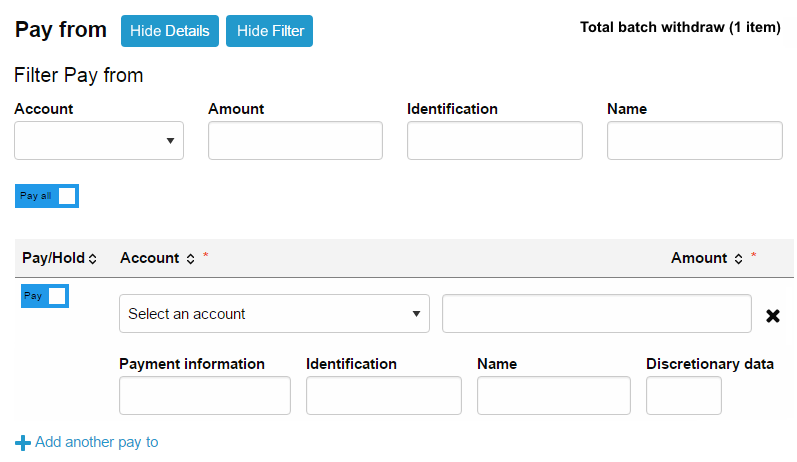

Pay From

Click the Show Details button to display additional details (for example, Payment information and Discretionary data) about the payment.

Click the Show Filter button to display the filter options (that is, Account, Amount, Identification, and Name). To filter by a specific category, begin typing in the respective field. For example, to filter by Amount, you could type 4,000-5,000 in the Amount field. The system then returns all payments that have a payment between $4,000 and $5,000.

The transfer type determines what additional fields display when you click or tap Show Details and Show Filter.

The ACH User Interface uses switches that change labels when you activate or deactivate the switch by clicking on them. We list these switches in the table that follows.

|

|

|

|

|

|

|

|

|

|

|

|

Filter Pay From

Account

The account number from the Originating Depository Financial Institution (ODFI) to filter by the account number.

Amount

The amount to be paid from the specified account to filter by the amount to be debited.

Identification

The information that they system associates with the originator of the ACH transfer to filter by the identification information. For example, George Washington.

Name

The customer name that the system associates with the account to be debited to filter by the name.

Pay all

Click the Pay all switch to turn on the Hold option for all transfers in the batch. A hold stops the system from submitting the indicated transfers to the financial institution during processing and saves the transfer for future use. To remove the hold for all the specified transfers in the batch, click the Hold all switch to turn on the Pay option and proceed with processing all transfers in the batch.

Pay/Hold

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Account

The account at the Originating Depository Financial Institution (ODFI).

Amount

The amount to be withdrawn from the account that you specify.

Payment information

A client-defined field that enables you to type notes about the transfer.

Identification

The information that the system displays when you click Display Details and then it displays the employee identification number that the system associates with the originator of the ACH transfer.

Name

The name of the account at the Receiving Depository Financial Institution (RDFI).

Discretionary data

The information that the system displays when you click Show Details. The system utilizes this information to enter codes of significance to the Originating Depository Financial Institution (ODFI) to enable specialized handling of the transfer. The field is optional and the system does not require it for the processing of ACH transfers.

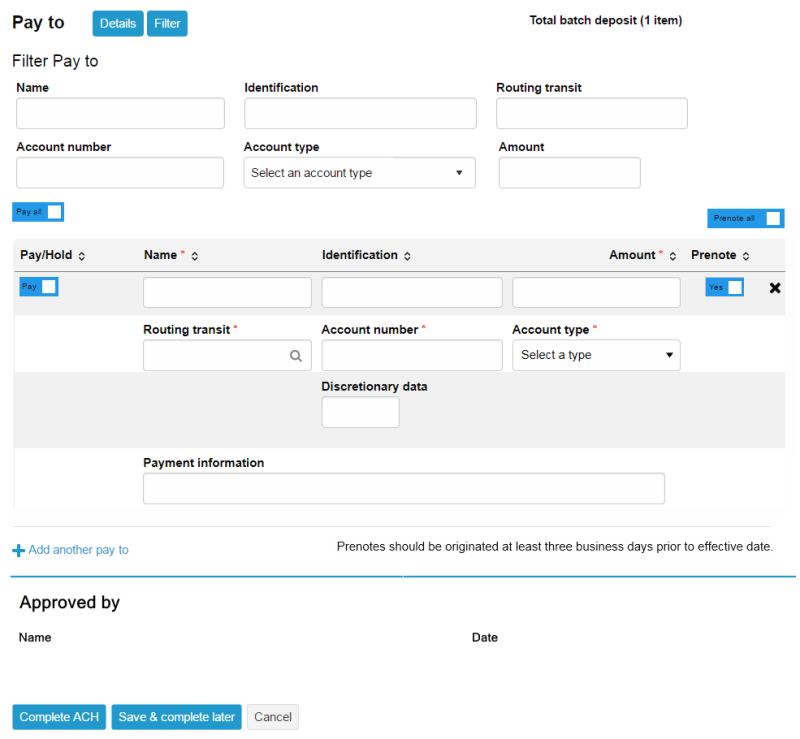

Pay To

Click the Show Details button to display additional details (for example, Payment information and Discretionary data) about the payment.

Click the Show Filter button to display the filter options (that is, Name, Identification, Routing transit, Account number, Account type, and Amount). To filter by a specific category, begin typing in the respective field. For example, to filter by Amount, you could type 4,000-5,000 in the Amount field. The system then returns all payments that have a payment between $4,000 and $5,000.

The transfer type determines what additional fields display when you click or tap Show Details and Show Filter.

The ACH User Interface uses switches that change labels when you activate or deactivate the switch by clicking on them. We list these switches in the table that follows.

|

|

|

|

|

|

|

|

|

|

|

|

Filter Pay To

Name

The name of the account that the system associates with the account to be credited to filter by the name.

Identification

The identification code that the system associates with the employee receiving the transfer to filter by the identification information. For example, an employee's employee number.

Routing transit

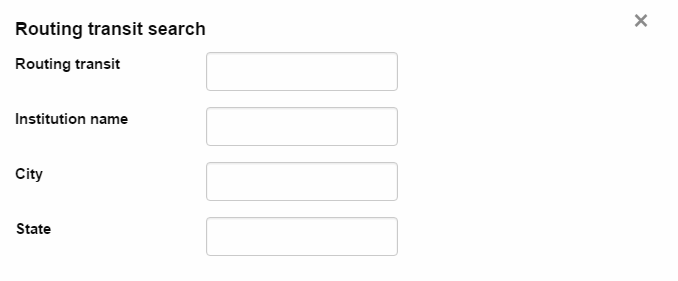

Click ![]() to search for the routing transit number that identifies the Receiving Depository Financial Institution (RDFI). When you click

to search for the routing transit number that identifies the Receiving Depository Financial Institution (RDFI). When you click ![]() , the system opens a new Routing transit search box. Use any of the following

, the system opens a new Routing transit search box. Use any of the following ![]() values to search for the correct routing transit number.

values to search for the correct routing transit number.

|

Routing transit |

indicates the routing transit number that identifies the Receiving Depository Financial Institution (RDFI). To search by routing transit number begin typing the routing transit number and the system automatically compiles a list of possible matches. |

|

Institution name |

indicates the name of the Receiving Depository Financial Institution (RDFI). To search by the institution name, begin typing the name of the institution and the system automatically compiles a list of possible matches. |

|

City |

indicates the name of the city of the Receiving Depository Financial Institution (RDFI). To search by the city name, begin typing the name of the city and the system automatically compiles a list of possible matches. |

|

State |

indicates the name of the state of the Receiving Depository Financial Institution (RDFI). To search by the state, begin typing the name of the state and the system automatically compiles a list of possible matches. |

Account number

The account number from the Receiving Depository Financial Institution (RDFI) to filter by the account number.

Account type

Indicates the account ![]() type from which the system credits funds to. You can use the Account type to sort the items that the system displays in the Pay to section

type from which the system credits funds to. You can use the Account type to sort the items that the system displays in the Pay to section

|

Select a type |

indicates that you need to select an account type (Default) |

|

Checking |

indicates that the system credits the funds to a demand deposit account |

|

Savings |

indicates that the system credits the funds to a savings account |

|

Loan |

indicates that the system credits the funds to a loan account |

|

General Ledger |

indicates that the system credits the funds to a general ledger account |

Amount

The amount to be paid to the specified account to filter by the amount to be credited.

Pay/Hold

Click the Pay switch to turn on the Hold for a single transfer. A hold stops the system from submitting the indicated transfer to the financial institution during processing and saves the transfer for future use. To remove the hold, click the Hold switch to turn on the Pay option and proceed with processing the specified transfer as part of the batch.

Name

The name of the account at the Receiving Depository Financial Institution (RDFI).

Identification

Payroll (PPD) transfers only. The identification code that the system associates with the employee receiving the transfer. For example, an employee's employee number.

Routing transit

The routing transit number that identifies the institution.

Account number

The account number at the Receiving Depository Financial Institution (RDFI).

Account type

The account ![]() type from which the system credits funds to.

type from which the system credits funds to.

|

Select Account Type |

indicates that you need to select an account type (Default) |

|

Checking |

indicates that the system credits the funds to a demand deposit account |

|

Savings |

indicates that the system credits the funds to a savings account |

|

Loan |

indicates that the system credits the funds to a loan account |

|

General Ledger |

indicates that the system credits the funds to a general ledger account |

Amount

The amount to be paid to the account that you specify.

Prenote

Select the "Prenote" check box to add a zero dollar prenote transfer for the current business day. Click the "Select All" hyperlink to place a check mark in all of the check boxes. Click the "Select None" hyperlink to clear all of the check boxes.

Payment information

A client-defined field that enables you to type notes about the transfer.

Discretionary data

The information that the system displays when you click Show Details. The system utilizes this information to enter codes of significance to the Originating Depository Financial Institution (ODFI) to enable specialized handling of the transfer. The field is optional and the system does not require it for the processing of ACH transfers.

Approved By

Name

The name of the person that approved the transfer (for example, Bank Admin)

Date

The date that the approver approved the transfer (for example, Mar, 17, 20XX 9:45 AM)

See Also:

Back to Top